Microsoft, the computer software and cloud platform provider, announced a 10-year strategic partnership with the London Stock Exchange Group (LSEG), the world-leading financial markets infrastructure and data provider. Microsoft will also purchase a 4% stake in LSEG through the acquisition of shares from the Blackstone/Thomson Reuters Consortium.

Microsoft estimates this partnership, and broader market opportunities, could generate an additional $5 billion in revenue for the company over the next 10 years, including the $2.8 billion minimum spend commitments from LSEG for cloud services and support.

The key to the partnership will be the digital transformation of LSEG’s technology infrastructure and data and analytics platforms onto the Microsoft Cloud, Microsoft said This will include the LSEG’s Refinitiv platforms that power over 40,000 financial institutions in 190 countries with data, analytics and insights across millions of active time series databases, daily evaluations, exchange trades and derivatives, equity quotes and significant research on public and private companies.

Following LSEG’s acquisition of the Refinitiv data analytics services platform in 2021 for $27 billion, LSEG has sought to differentiate itself in the market with an end-to-end proposition across trading, execution, data and analytics solutions.

“This strategic partnership is a significant milestone on LSEG’s journey towards becoming the leading global financial markets infrastructure and data business and will transform the experience for our customers,” said David Schwimmer, CEO of London Stock Exchange Group.

Those customers across the capital markets value chain face an increasingly complex operating environment with stricter regulatory controls, while their ability to deliver good customer experience is limited by legacy platforms, siloed information, and limits on scale, the LSEG said. This requires a digital transformation approach underpinned by modern cloud and AI technology.

With their partnership, Microsoft and LSEG say they plan to co-create an open, centralised, financial data platform for data democratisation, collaboration and new monetisation opportunities across the financial services ecosystem.

Microsoft says it also has plans to explore the development of digital market infrastructure based on cloud technology, with a goal to transform how market participants interact with capital markets across a broad range of asset classes.

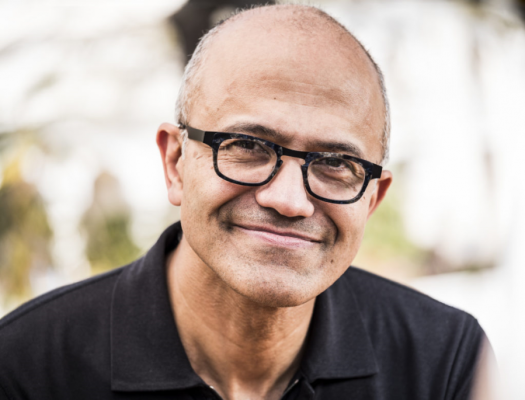

Chairman and CEO of Microsoft (pictured), Satya Nadella, said: “Advances in the cloud and AI will fundamentally transform how financial institutions research, interact, and transact across asset classes, and adapt to changing market conditions.

The two organisations also announced their plans to co-create the next generation of cloud-based analytics and modelling solutions, utilising LSEG’s analytics and modelling capabilities to enable powerful model construction, validation, diagnostics and deployment using Microsoft Azure AI, Synapse, Power BI, Excel and Teams applications.

Built on top of Azure Synapse, Azure Machine Learning and Microsoft Purview, the new cloud-based analytics and modelling solutions will enable users to expose, share and collaborate across proprietary and third-party data securely and confidently, they said.

[Image copyright: Microsoft]